Strategy Move

Recently, BOE announced an investment of 63 billion yuan in the construction of an 8.6-generation OLED production line. In the field of OLED panels, BOE has been following the proven technology route of Korean companies to compete in the global OLED panel market.

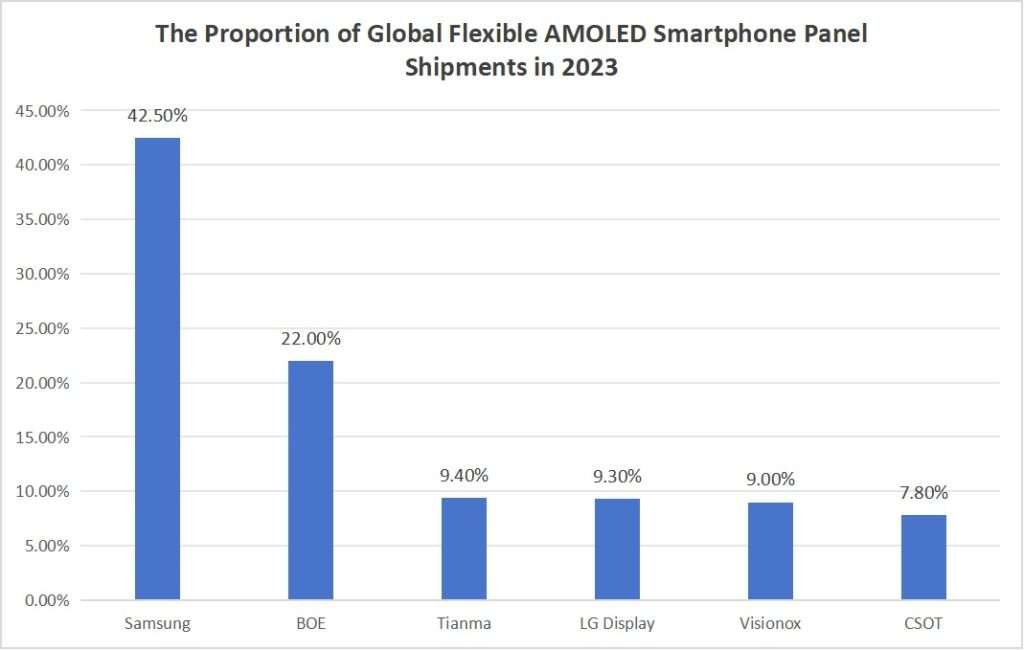

From Samsung Display in the small and medium-sized OLED market a dominant, to now the market share fell to less than 50%, while BOE and other Chinese panel supply head enterprises from 1% up to about 40%. Technology generation difference, according to the internal assessment of Korean companies only 1-2 years, this sense of urgency to be chased by the Korean companies as if the back.

Figure 1. The Proportion of Global Flexible AMOLED Smartphone Panel Shipments in 2023 (unit: percent)

Samsung Display and LGD have always wanted to invest in the construction of high-generation OLED production lines, but have been delayed by the international environment, market downturn, operating losses, capital and technology, and other factors. Samsung Display and LGD’s revenue and net profit in the third quarter of 2023 did not meet expectations, and LGD also had six consecutive quarters of huge losses. Although in 2023 all kinds of unfavorable factors come one after another, counter-cyclical investment is still the traditional strategy of Korean enterprises.

For its part, Samsung Electronics said it wants to accelerate the pace of executive renewal by appointing young leaders and technical talents. This paves the way for the Korean company to develop a high-generation OLED business in the future.

In April 2023, Samsung Display announced at a new investment agreement ceremony held in Asan Park, South Korea, that it would invest 4.1 trillion won (about 21.5 billion yuan) to build the 8th.6-generation OLED panel production line, which would then become the world’s first 8th.6-generation OLED production line for IT. However, in June, Samsung display and Japan Canon Tokki’s 8th.6 generation OLED vaporization equipment price negotiations stalled for a while and will restart again.

To realize LGD’s turnaround, LGD’s new chief executive officer, President Jung Cheol-dong (Jung Cheol-dong) will compete with Samsung display big customer Apple, then invest in the 8th generation of IT with OLED panel production line will be imperative.

The Chinese mainland in the field of counter-cyclical compared to Korean enterprises is more aggressive, the realm reached “walk the way of others so that others have no way to go”, BOE is an outstanding representative. The reason why BOE at this point “position”, announced the construction of an 8.6-generation OLED production line is also intriguing. BOE in the field of OLED investment and development has been to follow the strategy, neither to do “head out of the head”, nor “phoenix tail”, the benefit is to save a lot of R & D costs but also to enjoy the pioneers to cultivate a mature OLED market.

This close following put Korean enterprises in a very “difficult” situation, the “complaints” on the BOE and other Chinese mainland panels, the patent litigation war, and the talent war have not stopped in the last two years.

The Driving Force to Build High-Generation OLED Production Line

In the small-size OLED market, OLED screens (whether rigid or flexible) have become the standard of the flagship smartphone of the terminal brand, which has brought rich dividends to Samsung Display. Both Samsung Electronics’ flagship phone Galaxy series and Apple products have brought a steady source of profit to Samsung Display and LGD.

This year Apple is planning to fully shift its iPad product line from LCD screens to OLED screens. This strategic shift will be realized gradually over the next few years, culminating in 2024, when Apple expects to produce 10 million units of the OLED version of the iPad Pro, which Apple has already reached a cooperation agreement with two display technology giants, Samsung and LG.

Of these, Samsung will supply 4 million units of OLED panels, while LG is responsible for supplying the remaining 6 million units. So the market is the first driving force for Samsung Display and LGD to invest in a high-generation OLED production line.

On the other hand, the market is also a very important driver of BOE casting high generation OLED production line, such as BOE is likely to get a large number of Apple’s orders, the probability of being selected “Huawei chain” and Millet, Glory, OPPO / VIVO and other local terminal brand.

But taking into account the deflationary trend in China’s market situation this year, in addition to government investment, corporate investment, especially the emerging strategic manufacturing investment is the currently most in need, and the OLED display industry at the time, as a state-owned enterprise BOE to invest in building a high-generation OLED production line may have some kind of task, so that the country allocated to the local government of the national debt of one trillion dollars out of the idle in the banking system, to bring about Industry on the effectiveness and industrial transformation and upgrading.

The Risk Analysis of the Investment

Whether it is Samsung Display, LGD, or BOE, this investment in the construction of high-generation OLED production lines is focused on the field of medium-sized OLED panels for IT. According to Omdia data, OLED laptop panel shipments in 2022 will be about 6 million pieces, up 19% year-on-year. According to DSCC forecasts, by 2026 OLED in the high-end IT market will grow at a compound annual growth rate of 51% to 44 million pieces, OLED panels will occupy 75% of the high-end IT market share, is expected to OLED tablet PC screen shipments and revenue CAGR of about 49% and 46%.

It can be seen that the direction of investing in the construction of high-generation OLED production line and the project product market positioning are no problem, the market outlook is also very broad and substantial.

Compared with Korean enterprises, the investment announcement of BOE, regardless of the size of the capital, the main body of the investment and the proportion of the project, the project location, the project construction cycle, and so on have made a detailed disclosure, but the time for the commencement of the construction is not clear, because of uncertainties and risks before the start of the construction is very high.

Investing in a high-generation OLED production line is not easy in terms of technical realization, even with the existing mature small-size OLED panel production line, due to its optical and mechanical characteristics, different production equipment and process conditions are not the same, such as the mask problem, etc. Another concern is that the production process of medium-size OLED panels involves many microscopic physical and chemical reactions, which are prone to defects and defective products. Improving production efficiency and yield is one of the key difficulties of high-generation OLED production lines, not taking into account materials, equipment, and other factors.

For example, Samsung Display the world’s first IT with the 8.6-generation OLED production line, publicity to build in April but halted in June because of the price negotiations with Japan Canon Tokki 8.6 generation OLED vaporization equipment problems, had to be stalled for a while. The Korean media also broke the HB Solution to Samsung Display supply of U.S. Kateeva inkjet equipment was judged to be an “unqualified” problem. In the medium and large-size OLED development, Samsung Display is also in the trial and error technology, in equipment, cost, yield, and other aspects have to be considered comprehensively.

BOE replied to investors in the record showing that technology, based on the accumulated technical capabilities of the 6th generation of flexible AMOLED production line, to meet high-end IT products, apply the upgraded display technology in the form of Hybrid OLED-based in the 8.6-generation of AMOLED production, compatible with flexible OLED. Hybrid refers to the use of glass as the substrate, combined with TFE flexible encapsulation technology; the use of this technology combined with the company’s mature backplane technology and light-emitting device structure, can make the product with lower power consumption and longer life and better picture quality.

In terms of equipment, BOE’s total investment of 63 billion yuan RMB, accounted for about 60% or more, the actual amount of equipment preparation is more than 37.8 billion yuan. When Samsung Display and Canon Tokki in the 8.6 generation OLED vapor deposition equipment price talk collapse into a deadlock, Canon Tokki will also turn to BOE for a roaming price?

While the BOE and Korean enterprises together to the technical “no man’s land”, the stgrategy of following Korean enterprises will be effective, but also to bring the BOE’s huge risk and uncertainty.

Compared with Samsung Display investment of 21.5 billion yuan, BOE’s 8.6-generation OLED production line investment scale is 63 billion yuan, about 3 times difference, what makes the huge difference?

Risk of the Investment

According to BOE’s reply to investors’ questions, the capital expenditure for the construction of this project will mainly occur in phases over the next five years; taking into account the schedule of production line lighting, climbing, and solidification, it is expected that it will be possible to start depreciation in 2027. We analyze the gap in capital scale from the following three aspects:

The Industrial Chain is not Perfect

BOE’s investment amount is significantly higher than that of Samsung Display, which means that BOE has invested more in production equipment, raw material procurement, and R&D investment. Samsung Display in small-size OLED production is to take the vertical integration of production, in all aspects of cost reduction, this method of introduction of high generation line, compared to the BOE in the high generation OLED production line investment is less, not small.

Technology Routes Differ

Although BOE and Samsung Display are developing 8.6 generation OLED production line, but the two sides in the choice of technology route may differ. BOE uses Hybrid (hybrid) OLED technology, compatible with flexible OLED, while Samsung Display has its own technological advantages. Differences in technology routes may lead to gaps in product performance, yields, and other aspects of the two. In addition, BOE in the high-generation OLED production line in the face of technical “no man’s land”, research and development, and process technology will consume more money.

Industry Chain Layout

BOE also needs to continue the layout in the OLED industry chain of upstream raw materials, production equipment, and other fields, to reduce costs and improve competitiveness. Compared to Samsung Display, the scale of its use of funds may be even more massive.

In the track to high-generation OLED production line challenge, who can grasp the market, not only need to solve the problem of mass production and improve yields in technology but also test the timing and market uncertainties.

The OLED competition between China and South Korea is shifting to an area that requires higher comprehensive strength. The challenge is not only for specific companies but for the overall supply chain and technologies.

Related article